official aid

Foreign debt crisis in the early 1980s

While many developing countries accumulated a large volume of foreign debt, Poland, Mexico, Brazil, and Argentina were unable to repay foreign debt in the early 1980s. Under these circumstances, the Korean government promoted the introduction of foreign capital in order to finance development projects and current account deficit. For example, in order to promote foreign direct investment, the Korean government switched from a positive system to a negative system in 1983. Under the positive system, foreign direct investment was allowed in the sectors on the list. However, under the negative system, foreign direct investment was allowed in any sector if not on the list. As a means of opening up Korean capital markets to foreign investors, the Korean government permitted the issuance of first foreign beneficiary securities in 1981 and the listing of Korea Fund on the New York Stock Exchange in 1984.

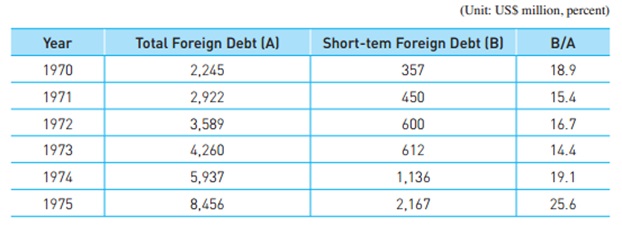

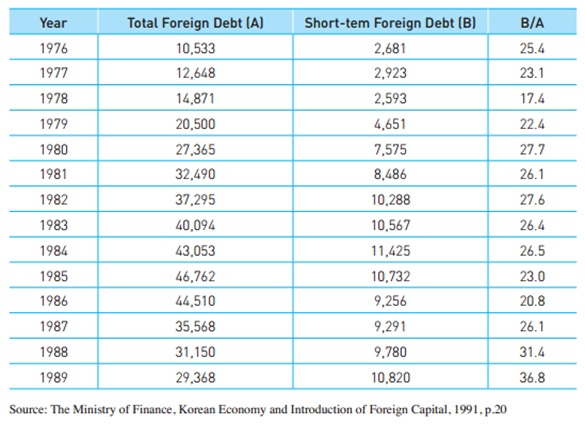

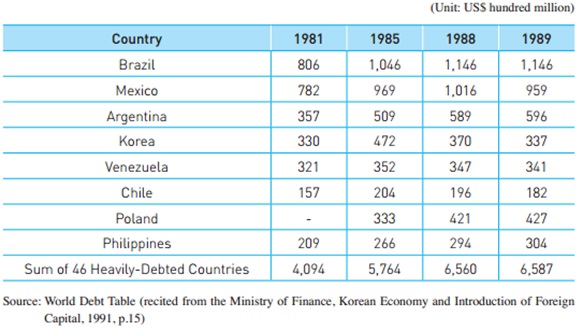

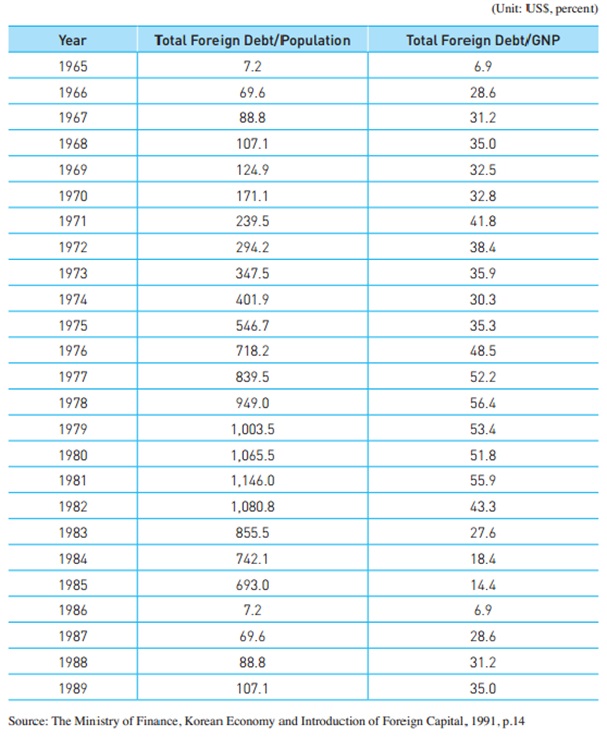

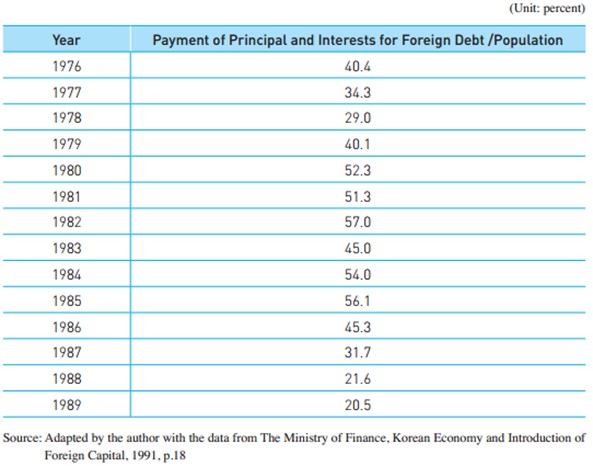

As Korea financed its development projects mainly through foreign loans since the early 1960s, Korea accumulated a large volume of foreign debt. The total foreign debt amounted to $2.25 billion, the proportion of short-term foreign debt was 18.9 percent, and the ratio of foreign debt to GNP was 28.6 percent in 1970. However, in 1985, the total foreign debt increased to $46.76 billion, the proportion of short-term foreign debt increased to 23 percent, and the ratio of foreign debt to GNP also increased to 55.9 percent <Table 1-1>, <Table 1-3>. Thus, in the early 1980s, Korea had the fourth largest foreign debt in the world, only surpassed by Brazil, Mexico, and Argentina <Table 1-2>. Also, as foreign debt indicators for Korea deteriorated in the early 1980s, there was a growing concern on the abilities of Korea to repay foreign debt. However, as Korea enjoyed current account surpluses in the late 1980s, the amount of total foreign debt began to decrease and foreign debt indicators improved <Table 1-4>. Thus, the concern on the abilities of Korea to repay foreign debt was not a serious one any more at the end of the 1980s.

[Table 1-1] Korea’s Total and Short-term Foreign Debt (1970~1989)

As Korea financed its development projects mainly through foreign loans since the early 1960s, Korea accumulated a large volume of foreign debt. The total foreign debt amounted to $2.25 billion, the proportion of short-term foreign debt was 18.9 percent, and the ratio of foreign debt to GNP was 28.6 percent in 1970. However, in 1985, the total foreign debt increased to $46.76 billion, the proportion of short-term foreign debt increased to 23 percent, and the ratio of foreign debt to GNP also increased to 55.9 percent <Table 1-1>, <Table 1-3>. Thus, in the early 1980s, Korea had the fourth largest foreign debt in the world, only surpassed by Brazil, Mexico, and Argentina <Table 1-2>. Also, as foreign debt indicators for Korea deteriorated in the early 1980s, there was a growing concern on the abilities of Korea to repay foreign debt. However, as Korea enjoyed current account surpluses in the late 1980s, the amount of total foreign debt began to decrease and foreign debt indicators improved <Table 1-4>. Thus, the concern on the abilities of Korea to repay foreign debt was not a serious one any more at the end of the 1980s.

[Table 1-1] Korea’s Total and Short-term Foreign Debt (1970~1989)

[Table 1-2] Total Foreign Debt for Heavily-Debted Countries

[Table 1-3] Korea’s Debt per Capita and Ratio of Total Foreign Debt to GNP (1965 ~1989)

[Table 1-4] Index for Foreign Debt Repayment (1976~1989)

Source: Lee, Jinsoo. 2013. Foreign capital in economic development: Korean experiences and policies. Seoul: KDI School of Public Policy and Management.