Korea’s electronics industry is perhaps its best-known industry around the world. In terms of industry share of Korea’s exports in 2015, electronics (including semiconductors, wireless communications devices, flat-panel displays, computers, and consumer electronics) came in first at 27.6%, with world-class competitiveness in each of the product categories, followed distantly by automobiles and auto parts at 13.5%. However, Korea’s electronics industry did not always have such a high stature. Over the course of a half century, Korea’s electronics industry was able to catch up with the world leaders through a combination of effective government policy and corporate strategy.

Based on changes in government policy and corporate strategy, Korea’s electronics industry development could be divided into four stages, as shown in Table 1: early years (1959-1965), formative years (1966-1979), rapid rise (1980-1992), and sophistication (1993-present).

[Table 1. Development of Korea’s Electronics Industry]

| |

Early Years

(1959-1965) |

Formative Years

(1966-1979) |

Rapid Rise

(1980-1992) |

Sophistication

(1993-) |

| Level of Technology |

Assembly,

Low level of localization |

Production of Consumer Products, Localization of non-core components |

Product diversification,

Localization of core components |

Quality upgrading,

Leading development of core components and materials |

| Major product development |

Radio (1959) |

B/W TV (1966), Color TV (1976), Microwave oven (1978), VCR (1979) |

PC (1981), TDX (1982), 64K DRAM (1983) |

Mobile phone (1993), Flat-panel display (1999), Smart phone (2009) |

| Government Policy |

Unsystematic (e.g., ban on smuggled products, campaign to send radios to rural villages, designation of industries specialized for exports) |

Export focus,

Anti-consumption bias,

Designation of priority products and support for investment,

Industrial complexes,

Education and R&D |

Shift from consumer electronics to ICT,

National Backbone Network System,

Development of leading technologies,

Co-operative R&D |

Infrastructure for informatization and e-government,

Exploration and support for new growth engines through public-private consultation |

| Corporate Strategy |

Inward-looking, Dependence on foreign technology |

Outward-looking, Technology acquisition and adaptation |

Development and production of core components, expansion of R&D |

Focus on quality management, aggressive investment in R&D and mass production, fast-follower and innovator strategy |

| Share of Electronics Industry (%) |

0.90 |

3.54 |

6.23 |

30.32 |

| 0.19 |

0.54 |

1.18 |

8.63 |

| World Rank |

- |

11 |

6 |

4 |

Source: Wonhyuk Lim (2016), The Development of Korea’s Electronics Industry During Its Formative Years (1966-1979), Sejong: Ministry of Strategy and Finance and KDI School.

Note: The share of electronics industry shows in percent terms the value added of electrical and electronic device manufacturing divided by manufacturing value added (top row) and GDP (bottom row), respectively, for the last ye.ar of each period (Bank of Korea, real GDP by economic activity, 1970-2015, in 2010 prices). However, figures for the last year of the early years, 1965, are quoted from KIST (1968). The final year of the sophistication period is 2015. 'World Rank' is the global rank of Korea’s electronics industry based on the amount of output in the last year of each period (Reed Electronics Research, Yearbook of World Electronics Data, 1973-2015)

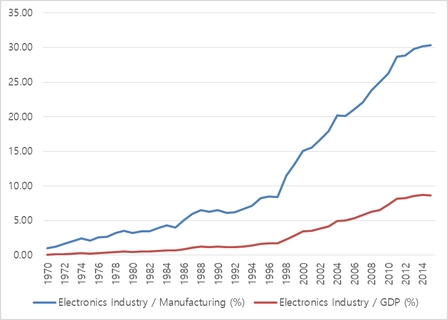

Figure 1 shows the share of the electronics industry in manufacturing value added and gross domestic product (GDP). The value added of the electrical and electronic device manufacturing industry, a proxy for the electronics industry, increased 2,141 times from 59 billion won in 1970 to 126,345 billion won in 2015, all in 2010 prices. The share of the electronics industry in manufacturing value added increased from 1.04% in 1970 to 30.32% in 2015, and the share of the electronics industry in GDP increased from 0.09% to 8.63% over the same period.

[Figure 1. Share of the Electronics Industry in Manufacturing and GDP]

Source: Bank of Korea, GDP by Economic Activity (Real, in 2010 Prices)

For several years after Goldstar (today’s LG Electronics) produced Korea’s first radio in 1959, Korea’s electronics industry was mainly focused on inward-oriented import substitution, and the government had neither a dedicated agency nor a comprehensive policy package devoted to the promotion of the electronics industry. However, after designating “radios and electrical devices” as one of 13 industries specialized for exports in July 1965, the government drafted in December 1966 a comprehensive plan to promote the electronics industry as an export-oriented strategic industry. At the time, Korea was looking for new promising industries, encouraged by its initial success with export-oriented industrialization focused on labor-intensive manufacturing (e.g., garments).

During the formative years for the electronics industry (1966-1979), the government strategically protected the domestic market and provided incentives for private-sector firms to develop, produce, and export electronic products designated for promotion. In the same period, many Korean firms entered the electronics industry and developed their core competence while engaging in vigorous competition. Korea’s electronics industry went from assembling relatively basic products like radios to producing more sophisticated products like color TVs and raised technological capabilities to such a degree that it could realistically think about developing core components like semiconductors.

After the formative years, Korea’s electronics industry entered a period of rapid rise (1980-1992), during which the government shifted its focus from consumer electronics to information and communications technology (ICT) and Korean firms diversified their products and developed core components and materials by greatly expanding R&D. The government lifted the anti-consumption bias of the formative years and tried to generate synergy between domestic consumption and exports, starting with its decision to allow color TV broadcasting in 1980. In addition, the government dramatically raised the innovative capacity for ICT by investing 3 percent of Korea Telecom’s revenue in R&D. During the same period, private-sector firms also greatly expanded their R&D, realizing that their continued dependence on the imports of core components and materials would limit their potential for success. As a result, Korea developed a digital switching system in 1982, and 64K DRAM in 1983 (third in the world, after the U.S. and Japan).

In the ensuing period of increasing sophistication (1993-present), the government and the private sector raised Korea’s electronics industry to world-class level by aggressively investing in core competence and quality improvement. The government provided key infrastructure for informatization and e-government and worked with the private sector to identify and promote new engines of growth. For their part, Korean firms pursued a fast follower-innovator strategy and aggressively invested in R&D and volume production. Although American or Japanese firms had first launched such products as the mobile phone, flat-panel display, and smart phone, Korean firms developed their own products shortly afterwards, and caught up with the first movers through aggressive investment and quality improvement. Furthermore, in some cases, Korean firms launched an innovative product ahead of incumbent leaders, as demonstrated by the success of the “phablet.”

Over the past half-century, Korea's electronics industry has greatly improved its position in the world market. In 1967, Korea’s production of electronic goods amounted to $55 million. It was only 1/400 and 1/67, respectively, of the U.S. and Japan’s production. In 2015, Korea ranked 4th in the global ranking of the electronics industry, behind China, the U.S., and Japan. Korea’s electronics production reached 43.0% of the U.S. and 60.0% of Japan’s.